Welcome to Hopkins CPA, your premier CPA firm in Corpus Christi, Texas, specializing in IRS Tax Resolution, comprehensive Tax Preparation (Business or Personal), and expert Accounting Services. Our team includes Former IRS agents, Tax Attorneys, and CPAs with over 150 years of combined experience, dedicated to resolving complex IRS issues. We offer strategic tax planning to save your business thousands, along with Controller/CFO consulting and cutting-edge accounting software integrations. Discover how we can optimize your business efficiency and success. Appointment required for personalized service.

About Us McKenzie Philosophy McKenzie’s philosophy and exercise should be to blend the complex, the practical and the business approach in the conduct of each and every audit engagement.

If permitted, your Refund Advance is going to be deposited into your Credit Karma Cash™ Spend (checking) account typically inside quarter-hour following the IRS accepts your e-submitted federal tax return and you might obtain your cash on the web by way of a virtual card.

Our staff defends your belongings from IRS seizures, utilizing demonstrated methods to negotiate settlements and cut down tax debt. With a strong track record of success, we assistance clients prevent or reduce house seizure and levy steps by way of expert illustration, including IRS Variety 668-W and Form 668-A. IRS Letters & Notices

TurboTax Dwell Complete Provider - File your taxes as soon as nowadays: TurboTax Total Assistance industry experts are available to arrange 2024 tax returns starting January six, 2025. 1-working day preparation and filing availability is determined by start time, the complexity of your return, relies on completion time for the majority of customers, and will change according to skilled availability.

Let’s face it. Keeping observe of all People expenses may be way too time using in for many really hard Operating truck drivers. Some of the ways truck motorists can lessen the amounts they owe are through trying to keep monitor of deductions:

If your IRS documents your return for you personally, you'll have to submit an amended return to show which the IRS submitted your return Completely wrong. But If you don't hold the documentation to support your refiled claim You then’re up the creek.

For IRS illustration, our price-based Audit Defense company is readily available for obtain (sold individually). If we are unable to join you to 1 of our tax gurus, We're going to refund the applicable TurboTax federal and/or state order value compensated. (TurboTax Free of charge Version customers are entitled to payment of $30.) This ensure is sweet for the life time of your CPA Corpus Christi individual tax return, which Intuit defines as seven several years within the date you submitted it with TurboTax, or for three yrs in the day you submitted your online business tax return. Further conditions and restrictions utilize. See Phrases of Services for information.

This Site employs cookies to enhance your expertise. We are going to assume you are Okay using this, however , you can decide-out if you want. Cookie settingsACCEPT

Attorneys that receive evaluations from their friends, although not a enough selection to establish a Martindale-Hubbell Peer Assessment Score, should have All those assessments Exhibit on our websites.

Anytime, any where: Internet access required; common data costs apply to download and use cell app.

Our knowledge has long been very full of professional data and self confidence. The private services and good conversation are superb.

Unless of course normally mentioned, Every single supply is not really accessible in combination with some other TurboTax offers. Specific discount presents is probably not valid for cellular in-app buys and may be offered just for a minimal period of time.

Among the most important specifications we uncover most truck motorists require In relation to their taxes is for a great bookkeeper or accountant who will help them.

Yes, our Corpus Christi tax law firm makes a speciality of addressing underreported tax return notices by conducting a radical Assessment of the money records to determine and correct discrepancies.

Barbi Benton Then & Now!

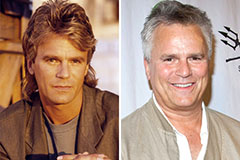

Barbi Benton Then & Now! Richard Dean Anderson Then & Now!

Richard Dean Anderson Then & Now! Mike Smith Then & Now!

Mike Smith Then & Now! Stephen Hawking Then & Now!

Stephen Hawking Then & Now! Ryan Phillippe Then & Now!

Ryan Phillippe Then & Now!